Recession-Proof Your Investment Portfolio 2022

Since we are currently in a recession, I think it is best we look into how to set up a recession-proof portfolio.

I have discussed this before, but investing during economic declines can do wonders for your portfolio. This is the time when you can take advantage of cheap prices, which can result in high returns in the near future.

That is why it is essential to understand how to set up your investment portfolio. We are discussing a portfolio that can weather the current economic decline and prosper for growth when the economy turns around.

Let's take a look at a few different options.

1. All-Weather Portfolio

The all-weather portfolio was created by Ray Dalio, who founded the world’s largest hedge fund, which manages roughly $150+ billion.

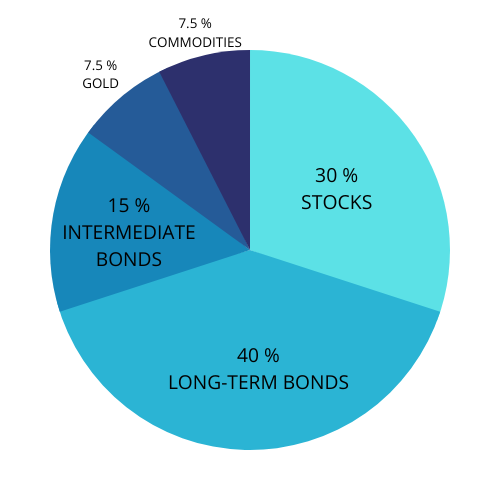

His strategy is to create a well-balanced portfolio that can perform well regardless of the economic cycle. The portfolio is divided between stocks, bonds, gold, and commodities. The portfolio would look something like this:

This is a portfolio designed to perform well no matter what happens in the markets.

If you would like to recreate this portfolio on your own, you can do this by investing in index funds or ETFs. Check out some of Vanguard’s index funds for the low expense ratios.

2. Classic 60/40 Portfolio

The classic 60/40 portfolio was founded by the founder of index funds and Vanguard, John Bogle.

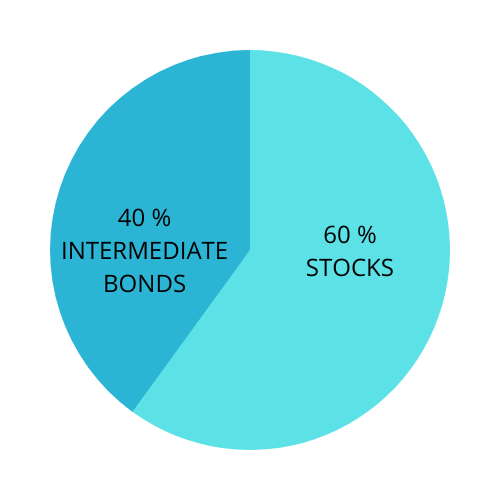

The idea of this portfolio is that you do not need to time the market while also having a well-diversified portfolio with low fees. It's very easy for any investor to replicate on their own. The portfolio would look something like this:

This classic portfolio consists of two funds. A total stock market fund and an intermediate bond fund. This combination of funds is designed to help you accumulate wealth through stocks and bonds to reduce the volatility of the market.

Note, if you are still in your 20s and 30s, you may want to reduce the percentage of bonds to about 10–20%. Since you are young and have more risk tolerance, this would allow you to gain better returns through your stock fund.

If you would like to recreate this portfolio on your own, you can do this by investing in index funds or ETFs. Check out some of Vanguard’s index funds for the low expense ratios.

3. Ivy Portfolio

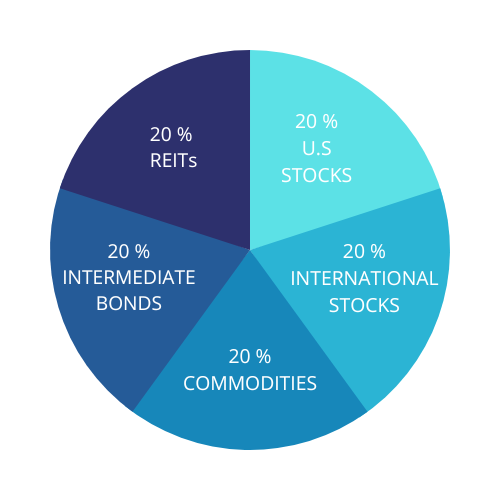

This portfolio closely mimics the investing strategy of college endowments.

This portfolio is equally allocated between all of its funds. This well-balanced portfolio has a different mindset from the previously discussed portfolios.

The portfolio is divided between U.S. stocks; international stocks; intermediate bonds; commodities; and real estate. The portfolio would look something like this:

I like that this type of portfolio exposes you to international markets and also real estate. However, the percentage allocated to commodities is too high in my opinion.

If you would like to recreate this portfolio on your own, you can do this by investing in index funds or ETFs. Check out some of Vanguard’s index funds for the low expense ratios.

Conclusion

Those were three ways to make your investment portfolios recession-proof. I really like the all-weather portfolio. However, if you want something simpler, then I would go for the classic 60/40 portfolio. It's called a classic for a reason.

The best way to go about this, regardless of which portfolio you choose, is to just add a set amount every month regardless of how the economy or the markets are performing.

Have a great week!

Muhamed

📖 Quote of the Week

Letting an index work its magic over the years isn't very exciting. It is only very profitable.

From The Simple Path To Wealth, By JL Collins