How I Saved My First $100,000 In Just 3 Years After College

Today we will discuss how I was able to save my first 100K and share the steps and strategies that allowed me to do it in just 3 years. The reason why I am sharing my experience is to inspire you to do the same.

I was fortunate enough to have a job lined up before I even graduated from college. Luckily, I graduated with the mindset that I was going to save a lot of money from my job, so I made it a goal of mine to save.

Even though many believe that saving your first $100,000 can be difficult and a far-fetched goal, I believe you can achieve it with ease with the right tactics. Let's look at the steps that helped me achieve this goal.

1. Debt Payoff

I was 22 when I graduated from college in 2017 with $37,000 in student loan debt. I got a job as an entry-level engineer with a starting salary of $63,000.

It was depressing to think that, after taxes, my salary was pretty much the amount I owed in debt. Meaning, if I did not spend my money on anything other than student loans, it would take me a year to pay them off.

Regardless, I decided that I needed to get rid of all my loans if I really wanted to achieve my financial goals. I implemented the avalanche method to pay off my loans faster and save money on interest in the long run.

During the pandemic, student loans went into forbearance, so I stopped making payments toward them in the hope they were going to get canceled soon. But I gave up on that and decided to make my last lump sum payment on March 17th.

It is crucial to free yourself from student loans and credit card debt early in your financial journey, especially if your debt has a high-interest rate. It can be discouraging at the beginning, but trust me, it pays off in the long run.

2. Financial Mindset

Within 6 months of starting at my first job, the company decided to give a raise to all entry-level employees hired within the past 9 months. They decided that we were underpaid and many were leaving to join the competition, so I was now making $70,000 a year.

I was ecstatic with that raise, and I cannot deny that I was already falling victim to lifestyle creep. I mean, I spent $5500 on a vacation in Dubai in just one week.

That is a lot of money to spend in just a week, no matter how I try to justify it. Needless to say, I had to take a step back and analyze my financial habits and goals.

This is when I started to take my finances much more seriously and really educate myself on personal finance. Here are the goals I set up at the time:

- Be more aggressive with student loan payments

- Increase my 401(k) contributions

- Bring lunch with me to work

- Use the MTA or walk more often

- Spend less on going out with friends

3. Retirement Investing

To follow up on my goals list, I decided to raise my 401(k) contributions from 6% to 14%. I kept it at 6% for the longest time to get my company match, even though I was matched at only half of that 6%.

This was perfect timing because after only 9 months at my first job, I was promoted and got another salary increase, putting me now at $84,000.

This really helped my 401(k) grow as I started to be aggressive with my contributions and my salary increase. Investing plays a big part in saving your first $100K.

My advice is to start early and max out your retirement plan contributions every year if you can.

At a minimum, invest enough to take advantage of your employer’s match. Don't leave any money on the table.

I love this method of investing because it gets taken out of my paycheck before it gets deposited into my account.

4. Budgeting

Do not think of a budget as limiting your spending. Look at it as a tool to help you figure out where your most unnecessary spending is. This was a real eye-opener for me. To my surprise, 25% of my paycheck was spent on buying lunch at work and eating out with friends for dinner.

This was when I started to really analyze my expenses and cut back on some of them to save money. You can do the same by implementing the following:

- Eliminate some of your monthly subscriptions

- Cook at home

- Skip Uber and use public transit

- Find a cheaper place to live

- Do free activities

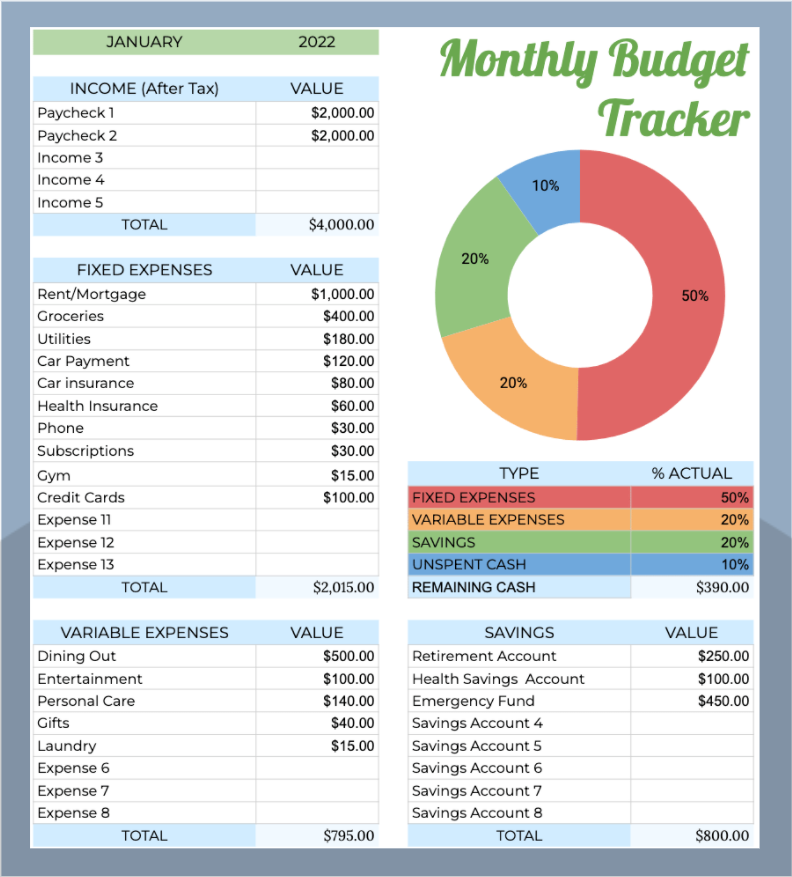

Monthly Budget Tracker Template

A simple tool to help you track your monthly spending and determine how much money to save and invest on a monthly basis.

5. Elevate Your Savings

When I first started to be conscious of my spending, I was only saving 20% of my paycheck. That is great, but as I learned more about personal finance and started cutting back on my expenses by budgeting, I was able to raise that to 50%.

This was a game-changer, as I was able to save up money for things that mattered to me and cut out the unnecessary bluff. For instance, I was able to spend 13K on my first car.

You do not need to cut back on every expense, but rather learn to save what you have leftover after your necessities, and then decide where to allocate that money wisely.

I was also able to save more since I got another promotion in 2019 and was now making $102,000. This time I was conscious of my lifestyle creep and kept my lifestyle the same to make good use of the extra income.

Note that at this time, my 401(k) grew to $46,000. I was also able to have an emergency fund of $6,000.

6. Taxable Investing

Elevating my savings helped me put down a downpayment on my first rental property. I put down $25,000 as a downpayment.

I decided to invest in buying a two-family house and renting it out for a steady monthly income. This way, the principal amount I invested is appreciating as the value of the house appreciates and I am making an extra few hundred bucks from rent.

I allocated a large portion of my savings to buying cryptocurrency. My portfolio at that time was hovering around $26,000.

But you can really invest your money in any appreciating asset. You can invest in building your own dividend portfolio or opening a Roth IRA. Just make sure you understand the difference between assets and liabilities before investing your money.

You can get started with any of these apps: M1 Finance, Robinhood, Coinbase, Gemini.

7. Optimize Your Credit

I’m a big fan of credit cards, but only if they're used correctly. I pay off my entire balance every month and never pay any interest to the banks.

I basically use them to get a discount on my purchases. For example, my Citi Double Cash Card gives me 2% cashback on all purchases. So, if I spent $10,000 on that card per year, I would get $200 cashback or 20,000 points that I could redeem towards travel.

Tiny purchases add up over the course of a year. I optimize my spending by using the right card for every category of purchase so I can earn back the maximum number of points. Then I use those points either to redeem them as cash or book travel.

My favorite credit cards are:

Bottom Line

Those are the steps I followed to reach my goal of $100,000 when I was just 25.

I am not saying that it is easy, but with the right mindset and strategies, it will be easier than you think.

Only you can take action toward your financial future. If you want to save and grow your money, start by setting your goals. Define an action plan to meet those goals and make sure to stay disciplined and consistent.

It will take time, but understand that every little bit of money helps towards saving your first $100,000. Eventually, you will have achieved that goal and will be thinking about making your first million.