Grow Your Money In The Stock Market

Welcome to my very first weekly newsletter.

Many of my family and friends are often hesitant about putting their money in the stock market. The fear of losing that money holds them back from making significant returns. Instead, they end up leaving their money in their savings account.

Here is how that is costing them money.

- The interest rate on a savings account is most likely less than half of one percent. That does not keep up with the average inflation rate of 3-4%. Last month, inflation was at 7.9%. This means money sitting in the bank is currently losing 8% of its value.

To keep up with inflation and continue growing your money, you must put your money to work — and the stock market is one great way of doing just that.

I often see people hung up between two ideas. They either think the market is too high and want to wait for a better time, or the market is currently crashing and it is not the right time to invest.

Well, the truth is that no one knows when the stock market is going to crash or when it will rise. Studies have shown that it is much more important to have time in the market than to time the market.

This means adapting a strategy where you will continue to buy whether the market is up or down is your best bet for long-term investing.

This is my favorite way to invest because it is completely passive. Simply, all you have to do is contribute a monthly amount to a low-cost index fund and let the magic begin.

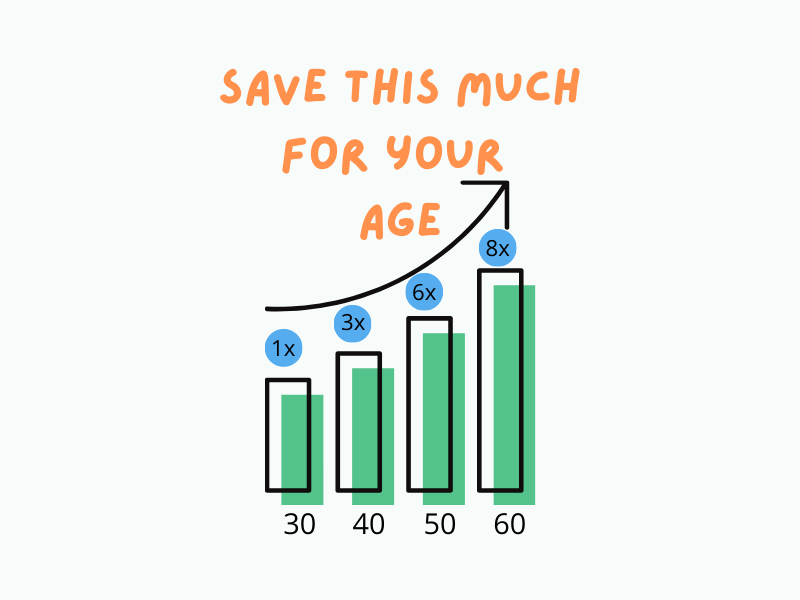

If you invest $1,000 per month in an index fund such as the S&P 500 for the next 30 years, the estimated value after 30 years is as follows:

Don't concern yourself if the market tanks immediately after you buy. You are investing for the long term, so allow the power of compounding to take place. It takes time for your money to start generating more money.

The stock market is one great way of making passive income. You don't have to buy individual stocks. If you are looking to reduce risk, low-cost index funds are the best way to get started. You can make an average of an 8–10% return on your investment annually.

Have an awesome week!

Momo

📝 Latest Blog Posts

📖 Quote of the Week

Never depend on a single income, make an investment to create a second source - Warren Buffet