How Much Money Should You Save By Age

If you are looking to retire early, then you should know how much money you need annually to live the lifestyle you want. The answer to this question varies by person because we all make different incomes, live in different parts of the world, and have different lifestyles.

If you ask me, I would need somewhere around $100,000 each year to retire and live the lifestyle I want. This gives me a perspective on what my retirement will look like.

If I retired at 60, I'd figure I'd have another 20 years or so to live.To be conservative, let's say 25 years, which tells me that I need $2.5 million in savings to retire comfortably. I got that by multiplying my annual expenses ($100,000) by 25 years.

But realistically, I do not want to be working till I am 60. I want to retire in my 40s. This lets me adjust my calculations. Now I need $4.5 million in savings to retire.

In order to reach your specific retirement goal, you should be conscious of your spending. Make sure to save enough money and to start investing early to meet your financial goals. The earlier you invest, the more time your money has to compound.

You can get started investing with M1 Finance.

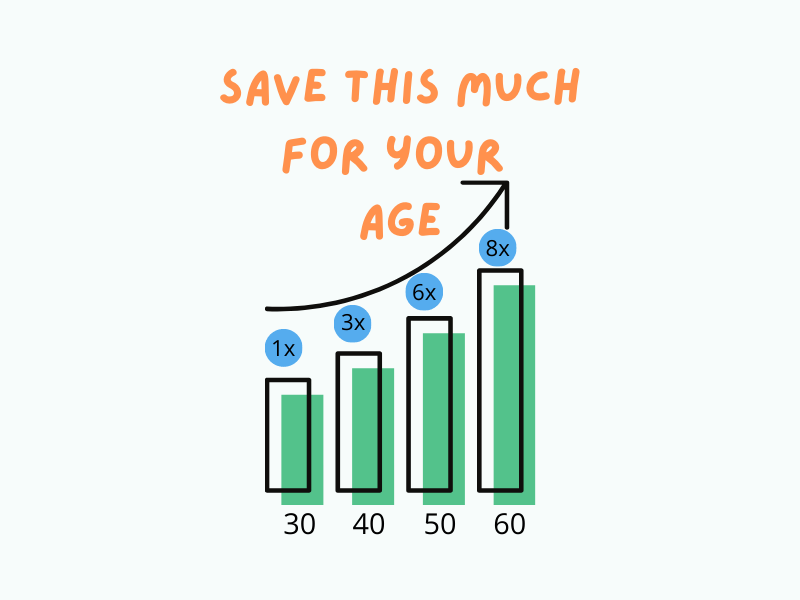

Let’s look at how much money you should be saving by age to stay on track for retirement.

1. Age 20

This is the age where most people have a negative net worth. This is because most students graduate in their early 20s with student loan debt. The goal at this milestone age is to make every effort to pay off any loan debt you may have.

The 20s are the most crucial time for your financial planning. This is the time where you develop your financial habits that will either set you up for success or failure going forward.

First, I advise that you start building your credit early in your 20s. Get a credit card and be responsible with it. Be conscious of your credit score because everything in the United States is based on how good your credit score is.

Second, get started on building your emergency fund. I would say in your 20s, 3 months of expenses would be sufficient. But if you have a family or kids, I would bump that up to 6-12 months of monthly expenses.

Third, set up your retirement accounts and start investing. If your employer offers a 401(k), then I would start there. Then move on to investing in a Roth IRA.

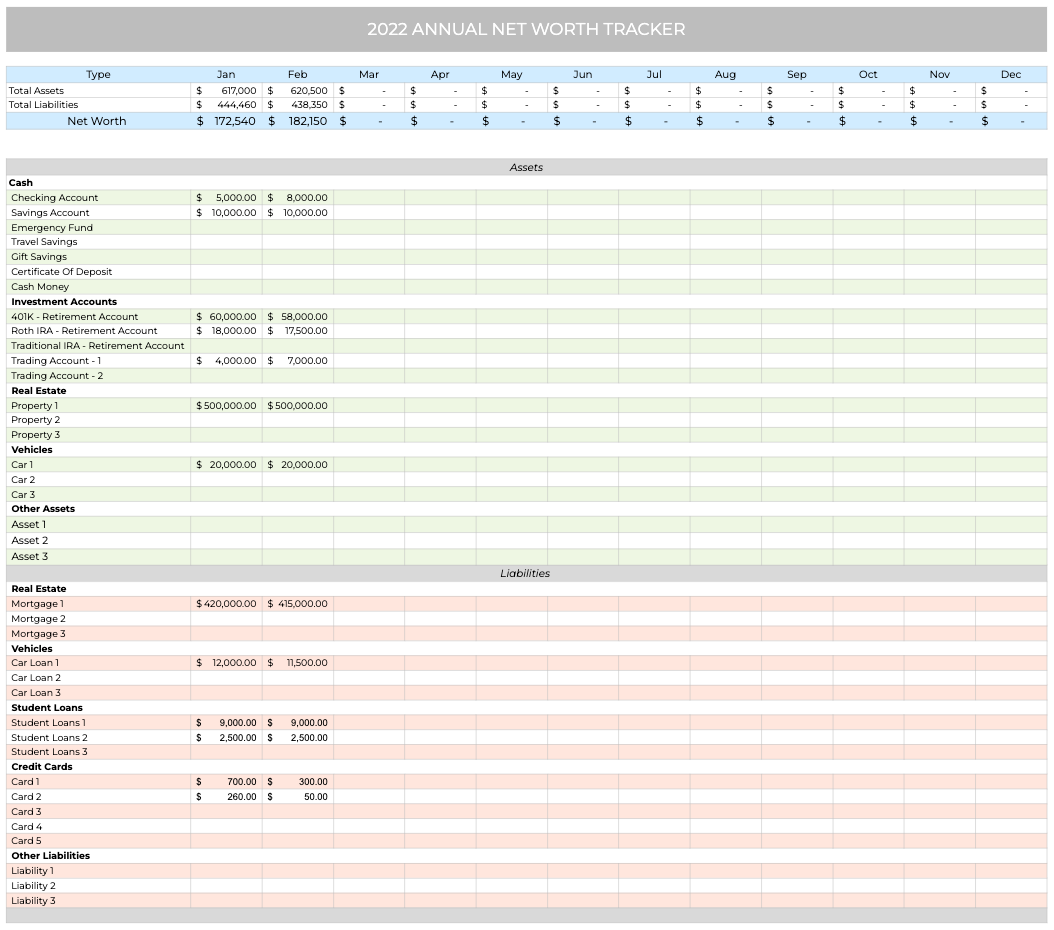

Aim for your net worth to be above $0, meaning pay off your debt. Use this template to help you figure out your current net worth.

Annual Net Worth Tracker Template

A simple and sleek way to track your annual net worth to stay on track to meet your yearly financial goals.

2. Age 30

By age 30, you want to have saved 1x your annual salary. Let’s say that you make $52,000 (that is the average American salary in 2021 and will be using it for the rest of the article), then you should have saved $52,000.

This savings includes, of course, your 401(k), Roth IRA, HSA account, and any other investments you may have.

The goals you should aim for in this age bracket are as follows:

- Save and invest a minimum of 20% of your income (aim for 30-40% if you want to retire earlier).

- Plan to become debt free (pay off any credit cards or student loans)

- Increase your income (ask for high raises every 2-3 years, switch employers for massive salary growth)

- If you are not happy with your income or your career, this is the time period when I would consider changing careers. (It gets harder to change careers once you hit 40)

- Aim to have a credit score of 760+

3. Age 40

You should have 2-3 times your salary by the age of 40.Based on a $52,000 salary, you should have around $156,000.

By now, you have probably started to realize how important investing is in your strategy to grow your money. By simply saving your money in the bank, it gets harder to meet these milestones.

You always want your money to work for you, not the other way around. Here are some goals you should aim for during your 40s:

- Know your retirement amount goal (what we talked about in the introduction)

- Save up for extra funds (college account for kids, second mortgage)

- Refinance your mortgage if you have 760+ credit

4. Age 50

By the age of 50, you should have 4-6X your current salary. Based on a $52,000 salary, you should have around $210,000–$310,000.

During your 50s, plan on hitting the following goals:

- Pay off your home mortgage (pay more than the minimum monthly mortgage amount)

- Shift your investment portfolio into a safer portfolio.

- Work on decreasing your yearly expenses

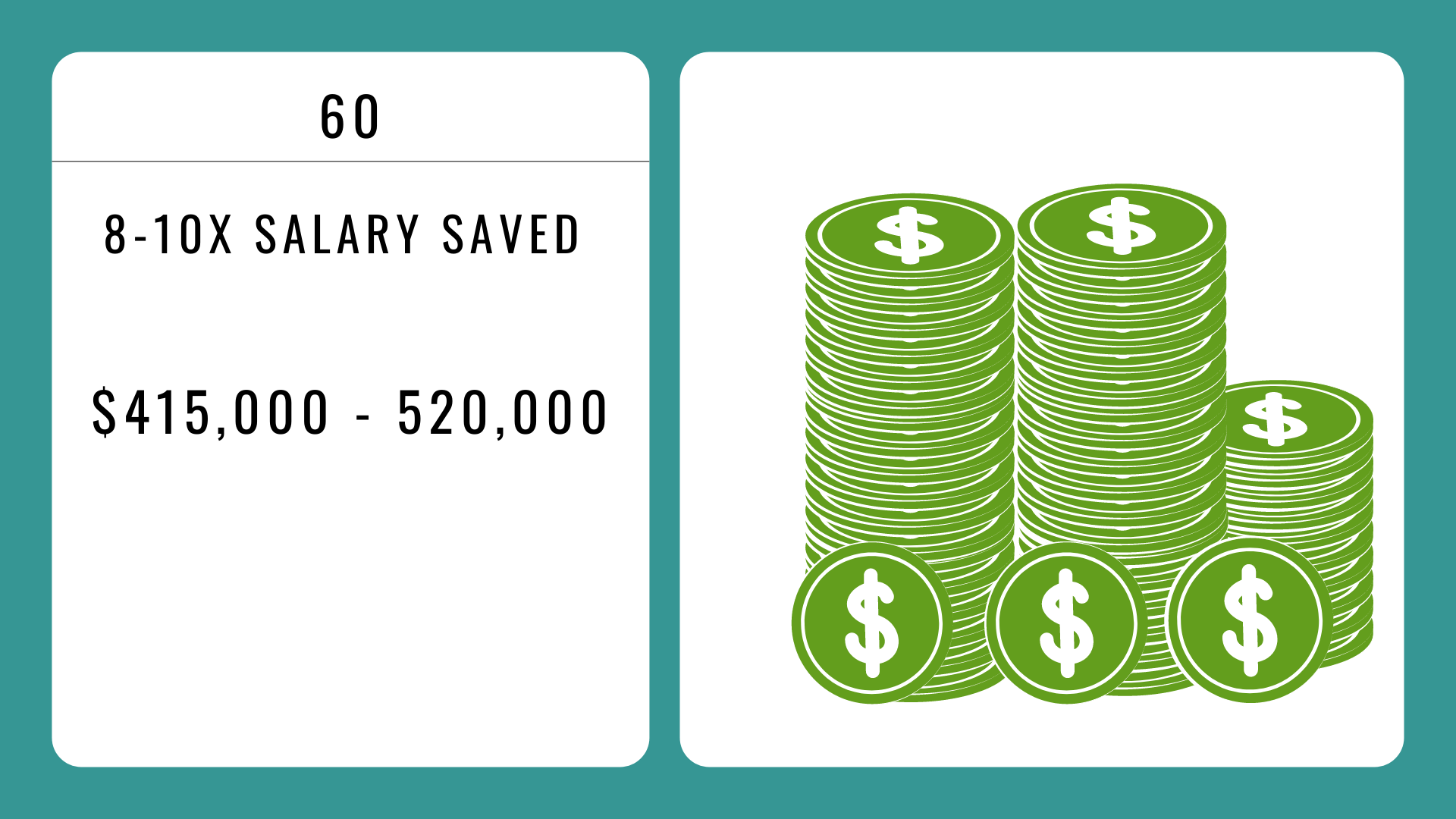

5. Age 60

You should have eight to ten times your income by the age of 60. Based on a $52,000 salary, you should have around $415,000-$520,000.

Priority goals for this age before retiring:

- Home loan paid off

- No debt

The 4% Rule

Most experts advise that your retirement annual salary should be just 4% of your total invested amount. Since I want to make $100,000 a year in retirement, I would divide that number by 4%, which would imply I need $2.5 million as my retirement amount.

Use this rule to figure out how much you need for retirement and start working towards that goal. The easiest way is to start investing in your 401(k) and Roth IRA. Once you have that in place, you can start to invest in real estate or other businesses.

Bottom Line

The ideal age to start saving is in your 20s. However, that is not always possible. Just make sure you are always saving at least 20%, and you will be hitting your benchmarks.

If you start to stray away from the numbers, take a look at your expenses and see where you can make some cuts. Remember to increase your savings from 20% to 40-50% if you want to retire earlier than 65.